Common Payment Flows

There are several possibilities on how to interact with the Payment System. Below are the most common flows for interactions between shopper, merchant, issuer, and the Payment System.

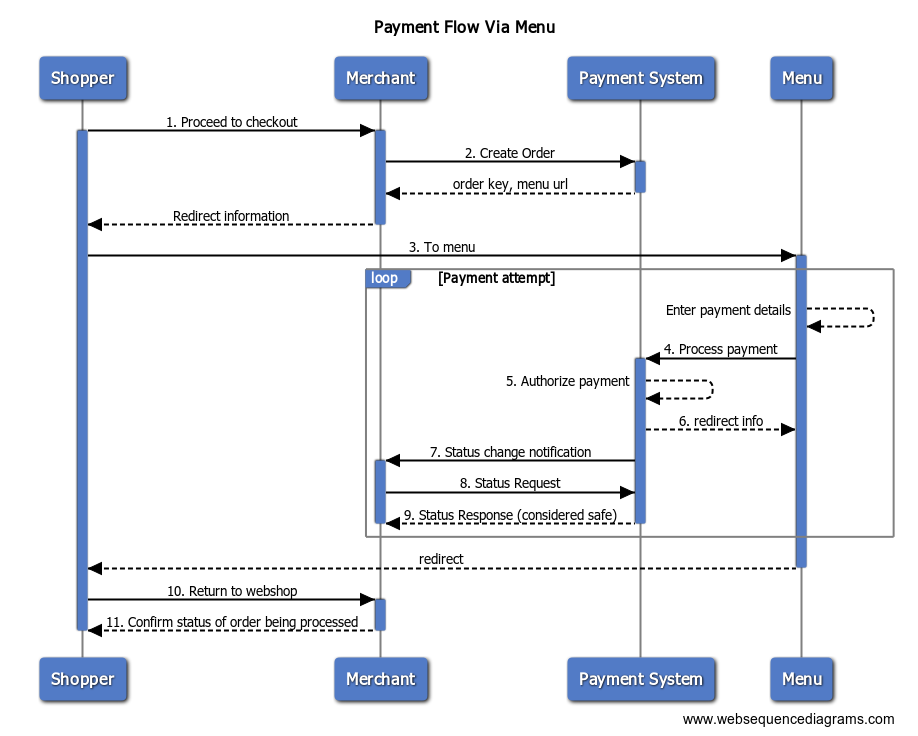

Payment Flow Via Menu

The Payments System provides a menu that can be used to let a shopper pay for an order. This provides the simplest integration with the Payment System.

The following diagram shows the payment flow using the menu.

Steps:

- The shopper has finished shopping and continues to check out to pay for the order.

- The merchant first creates an order supplying an amount and an order reference among other parameters. The Payment System returns a unique order key and the URL to the menu. The URL contains all the references to identify the order to be paid.

- The shopper is redirected to the payment menu.

- The Shopper selects a payment method from menu and enter the payment details and submits request to PS for processing.

- The Payment System authorizes the payment. Depending on the payment method the shopper can optionally be redirected to an acquirer for authentication.

- If the order is fully authorized the shopper is redirected back to the Merchant's webshop. Otherwise, he can attempt another payment, or cancel and return to the webshop without paying.

- By means of an asynchronous Status Change Notification the Payment System notifies the merchant when the status of an order including any payments has been updated.

- The merchant checks the status of the order (and whether the order is considered safe) using the order key as provided in the response of the create request.

- Payment System sends back the Status response with Confidence level (considered safe) which helps merchant decide whether to ship the products.

- The shopper returns to Merchant's webshop.

- The landing page of the webshop can be used to display a confirmation of the order to the shopper.

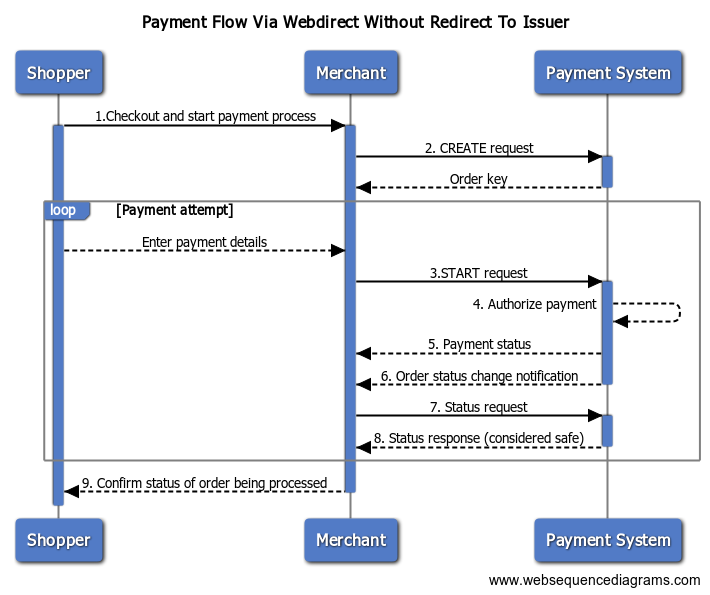

Payment Flow Via WebDirect without Redirect to Issuer

The following diagram shows the payment flow using API calls (WebDirect) without a redirect to an issuer.

Steps:

- The shopper has finished shopping and continues to check out to pay for the order.

- The merchant first creates an order supplying an amount and an order reference among other parameters. The Payment System returns a unique order key and the URL to the menu. The URL contains all the references to identify the order to be paid.The menu URL can be ignored.

- Using the unique digital key as provided in the response of the CREATE request, the merchant then initiates the creation of a (Payment) Order using the START request.

- The Payment System authorizes the payment depending on the provided details.

- Payment System will return the status of the payment.

- By means of an asynchronous Status Update call Payment System notifies the merchant when the status of an Order has been updated.

- The merchant checks the status of the order (and whether the payment has been authorized successfully) using the order key as provided in the response of the CREATE request.

- Payment System sends back the Status response with Confidence level (considered safe) which helps merchant decide whether to ship the products.

- Merchant confirms to shopper that order is being processed.

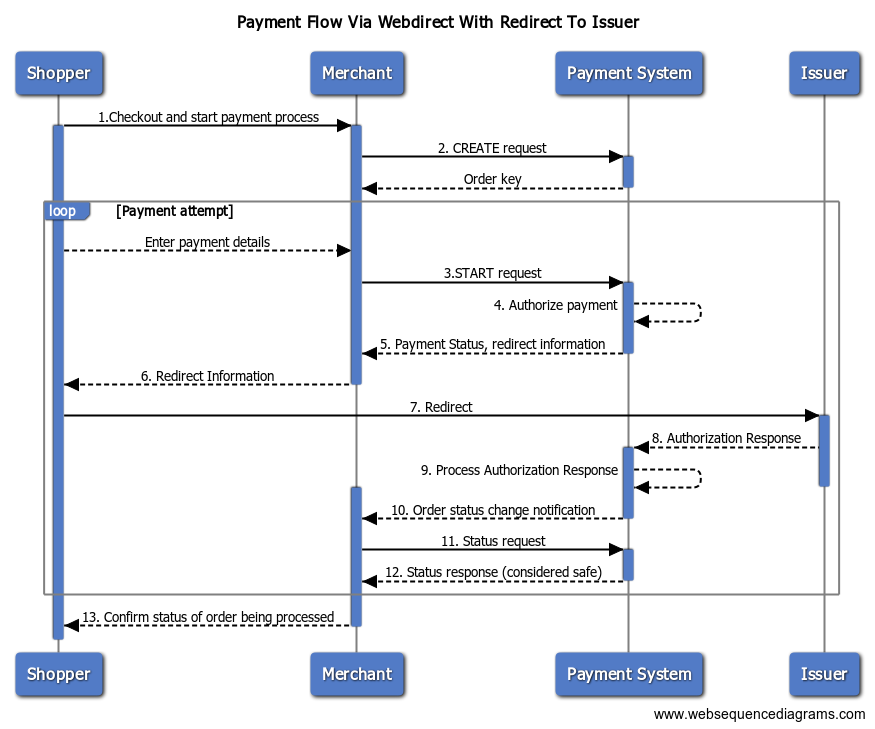

Payment Flow Via Webdirect with Redirect to Issuer

The following diagram shows the payment flow using API calls (WebDirect) with a redirect to an issuer.

Steps:

- The shopper has finished shopping and continues to check out to pay for the order.

- The merchant first creates an order supplying an amount and an order reference among other parameters. The Payment System returns a unique order key and the url to the menu. The url contains all the references to identify the order to be paid.The menu url can be ignored.

- Using the unique digital key as provided in the response of the CREATE request the merchant then initiates the creation of a (Payment) Order using the START request.

- The Payment System authorizes the payment depending on the provided details.

- Payment System returns the status of the payment and redirect information.

- Merchant sends the redirect information to Shopper.

- Shopper is redirected to his/her Issuing bank for Authorizing payment.

- Payment System receives Authorization Response from Issuing bank.

- Payment System will process the Authorization Response.

- By means of an asynchronous Status Update call Payment System notifies the merchant when the status of an Order has been updated.

- The merchant checks the status of the order (and whether the payment has been authorized successfully) using the order key as provided in the response of the CREATE request.

- Payment System sends back the Status response with Confidence level (considered safe) which helps merchant decide whether to ship the products.

- Merchant confirms to shopper that order is being processed.

Updated over 1 year ago